GV junior mining portfolio

Note: This was not written by a financial professional, and is not intended as financial advice

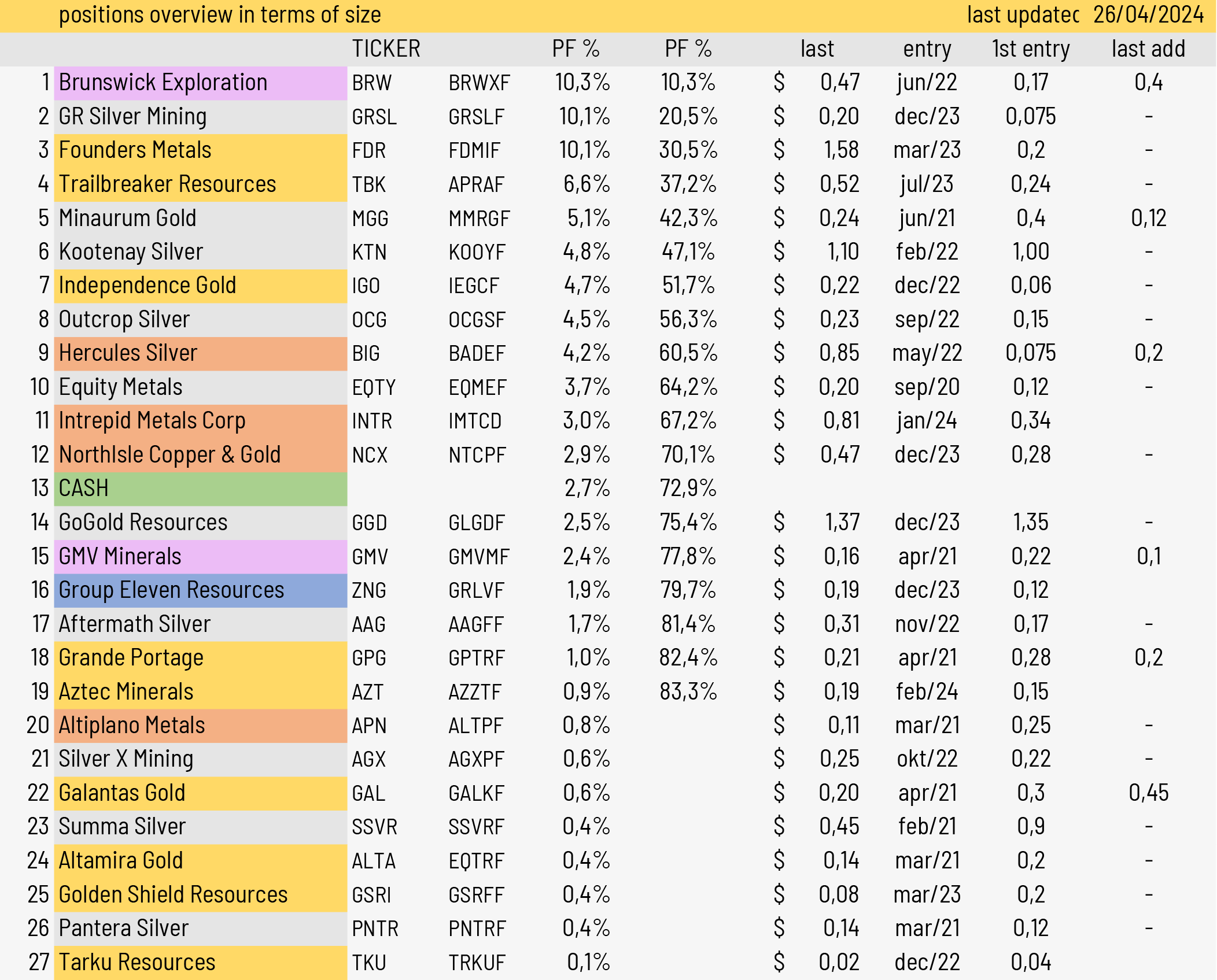

with this new format showing all metal stock positions in one single overview, the aim is to give a better insight in position sizing and manage risk by a good diversification between hard commodities, metals (as some tend to go all-in in Silver or Uranium, two hyped markets).

portfolio will be updated regularly and more info will be in the twitter feed.

Current exposure by metal: see colored lines in PF below. purple = lithium, yellow = gold, grey = silver, bronze = copper.

TOP POSITIONS

SMALL POSITIONS

in no particular order, small positions but in this sector these can grow quickly.

for a big portfolio, they provide extra optionality. just last few weeks equity metals went from very small to n°7 overall

Stelmine Gold $STH.v | Blue Lagoon Resources $BLLG.cn | Trifecta Gold $TG.v

Golden Sky Minerals $AUEN.v | Sylla Gold $SYG.v

last action: rotated $GSVR.v to silver stock Minaurum Gold, sold final tranche of Snowline Gold to generate cash

Why junior mining companies?

A basket of well selected juniors with a focus on exploration will always outperform major producers, in upturns but even more in downturns.

While majors keep making new lows juniors have bottomed and building a new base to launch.

While for the 2020 leg (the 1st leg in the new Silver bull market) i focused mainly on proven ounces and development stories, i prefer for this next leg to focus on 1st optionality/proven ounces AND 2nd the most exciting silver discoveries = exploration and add to this some junior producers with agressive business development (Gsilver , Santacruz). Focus is newsflow.

i also like new stories with strong historical data at tiny Mcaps as they have a natural floor and provide a very assymetric bet for potential huge gains (CMC, Hercules, Equity, GMV minerals), these are higher risk and my advice is allways hold all positions.

Main criteria for selection:

management team & business development

share structure

newsflow and possible dilution, cashed-up or not

the asset

grade & number of ounces

the odds to become a mine

takeover candidate

jurisdiction (south america is not a problem for me as long as the overall PF has sufficient spread)

Since March 2021 Gold Ventures works with a due diligence team to scan & follow up on possible holdings: results during the last 18 month bear market have been stellar compared to peers & newsletters.

aim is to ride a Silver short squeeze in Junior silver mining stocks.

during the 2021 bear market, this PF managed a +11% gain (overall gold/silver/commidities result); when the bull resumes i am expecting a multibagger return.

how high can these go in the next bull leg? Let’s say #silver goes to $35 from $18

all these Junior companies would become 5-10 baggers in a very short period of time.

Silver NYSE traded midtiers.

i prefer juniors over majors. Many majors have been very dissapointing on meeting expectations/revenues.

in my opinion a strategy of quality juniors has the same or a bigger potential as buying leaps on majors, without expiration time value.

Expect averaged huge returns (100 bagger potential) over the total length of the bull market since the march 2020 lows.

This portfolio is based on 1 simple fact: Silver will eventually exceed it’s highs ($50), i expect this to happen in 2024.